Part 3 - Evolution

How are blockchains evolving in timeI’d make an educated guess that if 99% of people were asked to visualise money, they would imagine mounds of notes and coins. Unless you’ve been living under a rock, however, you will know that most money exists only in digital form, as numbers on a computer screen; this has been true for decades.

So, if most money has been digitally based for so long, what is it that makes digital cryptocurrencies different from ordinary digital money?

One key difference is that digital money exists only as a number that can be created or destroyed. In contrast, a unit of cryptocurrency has a distinct existence which can be traced.

The mechanism that enables this traceability is what we call the blockchain, something that we have only mentioned in passing as yet.

Do they know where money comes from?

What is the blockchain?

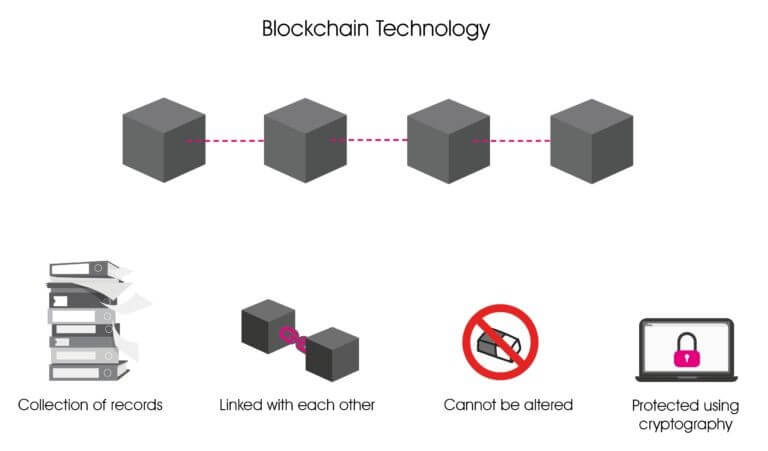

Briefly, blockchains are a form of database that are used to enable, verify and organise cryptocurrency transactions. As databases, they both create and store information about every single transaction that takes place using the currency.

The blockchain itself is formed of separate packages of information, known as blocks, each of which contains encrypted data about separate transactions between the nodes. As new data is collected from new transactions, they are collated together in a new block, which is chained to the previous ones in chronological order.

To continue the lithic theme, the beauty of the blockchain is that it is metaphorically set in stone – that is, once a block has been formed, it cannot be altered or influenced by any individual. It remains a permanent record of the interaction between the nodes, meaning that transactions can be traced back to their source.

Blockchains are for life, not just for money

It is a truism that it takes time for any particular innovation to percolate through society, and this is just as applicable for blockchains, which have endless potential uses, from securing business contracts, to voting.

Blockchain voting – Biden’s worst nightmare?

So far blockchains have mainly been used to secure payment systems for cryptocurrencies, in order to create trust between anonymous agents in the absence of a central authority. However, this has not been without problems.

My Bitcoin went to market, and it bought….

Blockchains differ from normal databases in that they are distributed – that is, they are stored in a decentralised fashion amongst all the separate participants in the blockchain, each of which is known as a node.

Updating and verifying new transactions on the blockchain involves a competition between nodes to solve mathematical puzzles using oodles of computing power. Known as ‘proof of work’, this is the mechanism by which new bitcoins are issued, as the solver of the puzzle updates the blockchain with the most recent transactions, and collects the predetermined reward of new coins.

The problem is that every transaction that takes place involved verifying every other transaction – rather like a memory game where players have to remember ever-growing sequences. As the historic list of transactions grew ever longer, it didn’t take long for this process to become very unwieldy. As the blockchain requires computing power, and hence, electricity, this ever-growing energy usage has become a stick to beat the Bitcoin community – cast as selfish energy hogs by hysterical catastrophists.

One early, and primitive, method of solving the problem of inefficiency was adopted by my favourite folk (not!) – the custodial exchanges.

Just as a recap, our last two posts discussed how the custodial exchanges enforce the use of KYC, and controlled the private keys of their clients. We also discussed some of their primary weaknesses, like the vulnerability to hacking. Their one great strength is that they offer rapid and cheap trading to the customers. The major reason for that is that they only interact intermittently with the underlying blockchain of each currency – through the use of what is called off-chain trading.

Rather than every transaction being immediately and specifically verified by the blockchain, the internal balance sheet of the custodial exchange site is used to track any conducted trades. In effect, these are skimping on their blockchain usage, in order to save time and money.

The problem with this is a loss of transparency and security. With the early incarnations of blockchain, you truly did get what you paid for, and those opting for the speed and cheapness of the custodial exchange were sacrificing the absolute security that cryptocurrencies were supposed to ensure. Nonetheless, for most practical purposes the off-chain solution to the problem of the scalability of the blockchain was a good one, at a time when this was the only means of making the blockchain scalable.

Scalability – not just for Russian dolls

Scalability was not the only important limitation when it came to the Bitcoin blockchain. As a dedicated blockchain, it could only facilitate financial transactions using Bitcoin itself, so if developers were going to ensure wider adoption of blockchain technology, they needed something that could be adapted to different circumstances…

The Ethereum blockchain was the first attempt to provide a universally useful blockchain. Launched in 2013, it was designed to underpin all sorts of decentralised applications as well as financial transactions, and has been wildly successful. Numerous applications have been built based on Ethereum.

Some of the shine has come off it of late, however, as it has suffered from high fees and energy costs, and embarrassingly-slow trading times. Developers are attempting to find solutions to these problems, and Ethereum remains the second most prominent blockchain, but it will be interesting to see if it maintains its prominence over time, because…

... Here comes the competition

Bitcoin has been able to resolve many of its problems because of improvements in blockchain technology, but those same improvements have been used as the basis for other, newer, cryptocurrencies using ever more sophisticated blockchains. (Meanwhile most mainstream journalists are oblivious to these improvements and carry on parroting the ‘Bitcoin doubleplus bad’ line. In the crypto space, problems have usually been resolved long before the media even begin talking about them.)

‘Altchains’ is the short form for ‘alternative blockchains’; that is, any other blockchain apart from that of Bitcoin or Ethereum. Rapid improvements in blockchain technology are now spawning an ever-growing stable of competitors, which are faster, considerably cheaper and have greater functionality than their more famous predecessors. You may have heard of some of them – Avalanche, Solano, Meter, Polkadot, Cosmos and EOS are just a few examples – but new ones are launched with exhausting regularity (exhausting for those trying to keep track of them all).

Proof of Stake

One of the salient innovations has been the introduction of a new process for adding new transactions to the blockchain, and new coins to the ecosystem. Instead of proof of work, which requires the solving of mathematical puzzles, ‘proof of stake’ uses groups of ‘validators’ who lend (or ‘stake’) their own crypto in the hope of earning a reward.

The chances of winning the validating competition depend on how much crypto the validator stakes, and how long it has been staked, thus rewarding commitment to the project. This also created the possibility for ordinary holders of the currency to benefit financially, as they can delegate their own crypto holdings to validators, earning interest as a result. The interest comes from the fees paid when trading the currencies.

Being a validator isn’t for the flaky or shallow-pocketed. It requires relatively high quantities of crypto, technical proficiency and a continual presence online to maintain the nodal network. Failure to maintain the requisite standard can result in being ‘slashed’ – the partial loss of staked crypto. These losses will be shared by those who delegated their crypto to validators, so anyone looking to delegate needs to do their homework first.

Cross-Chain Atomic Swapping

Putting these risks aside, one of the advantages of the new altchains is that, from the get-go, they were designed to enable easy interaction between different blockchains, and hence different coins (this had not been the primary focus of the blockchain pioneers, for the understandable reason that other blockchains – or competitor coins – did not then exist!).

When new cryptos first began to be launched in the first few years AB (Anno Bitcoin), it was cumbersome to trade different pairs of altcoins which relied on different blockchains. It would be done using BTC as a kind of middle man, but this was time-consuming and expensive. Let’s imagine you had some Monero and wanted to buy Dogecoin (a bit like swopping diamonds for dung, but humour me). You would first have to sell Monero for BTC, and then buy Dogecoin with BTC – incurring two sets of fees, and some ground-down teeth.

This was clearly marvellously lucrative for the exchanges, but expensive and irritating for the purchaser. This practice still goes on, on the centralised exchanges, which get away with it as the majority of their users are crypto-naïfs with relatively little interest in the many alternatives to Bitcoin and Ethereum. But fortunately for those interested in Life Beyond Bitcoin, this problem has been largely resolved by the introduction of an important innovation – atomic swaps.

‘Atomic’ here doesn’t refer to explosive and toxic releases of energy, but from the term ‘atomic state’ – when something either happens or not, with no other option. Atomic swaps occur when currencies from different blockchains are exchanged in such a way that if one party does not get the currency they wanted, then neither party will – making the swap secure and trustworthy.

With the introduction of atomic swaps, currencies on different blockchains no longer need to be converted into BTC – they can be directly exchanged. Atomic swaps have therefore greatly increased the convenience and efficiency of crypto transactions, and reduced prices too.

Decentralized

Atomic swaps have been made possible by the decentralised exchanges, or DEXs, which are an increasingly popular alternative to the centralised exchanges. Instead of visiting a single site, using off-chain trading in the old clunky (and insecure) way, DEXs are separate apps which users download to their phone or desktop, from which the trading is conducted between the buyer and the seller without the intervention of a third party.

Trading is on an open-source, on-blockchain (altchain) platform, using smart contracts. Smart contracts are simply programmes that are fulfilled when certain steps are undertaken, and in this case, they act as automated escrows. Their purpose is to make it difficult for anyone to run off with the money without fulfilling their side of the bargain.

DEXs therefore represent a tremendous improvement in security, when compared to centralised exchanges. They remove any need to give your private keys to another entity, and the DEX itself is as unobtrusive a presence as possible. They aren’t completely watertight (money has been stolen from decentralised sites) but they have the great virtue of putting control into the hands of the participants. Reflecting this, the use of DEXs has exploded since their inception.

The rolling crypto gathers no rust

In the crypto space, nothing stays still for long. Blockchain technologies have improved immensely in the last years, and if anything, the frenetic pace of change is only increasing. As I type this, some bright spark is dreaming up something that will make most of what I have written redundant.

One area that has remained relatively stable, however, are the choices available when it comes to storing our bitcoins – the various forms of wallets. We will be exploring the different storage options in the next installment of our series.

The No Hype Crypto Service

If you want to get deeper into the crypto subject, getting (very interesting) coin alerts, market reports and be backed by a community of like-minded helping each other out, then you might want to join the No Hype Crypto Service! Learn more about it on this page

Thank you for reading!

Anna, investor and team member of No Hype Invest!