Part 1 - Privacy

The purist’s guide to cryptocurrencyFor any child growing up in the 70s, it was hard to avoid Westerns. Maybe half of the films on TV featured cigarillo-chewing dudes sweating in deserts. Most families only had one TV, so if your dad liked Westerns, the whole family had to bloody learn to like them too (equal opportunity families were still a rarity).

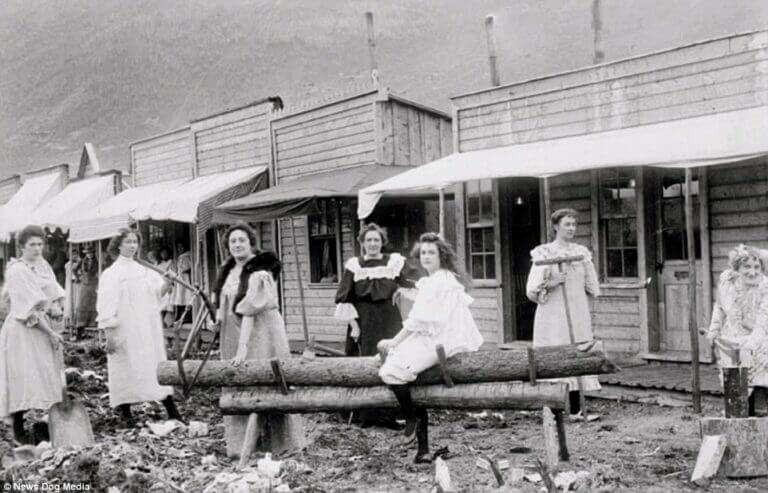

What has crypto got to do with cowboys and Indians? Only that the Western gave us the metaphor of the Wild West – a place where pioneers battle the dangerous unknown so law and civility could triumph for all. In crypto terms, we aren’t quite at the beginning of that process – we now have a Main Street, a saloon and a bordello – but we are still some way off opening up crypto to everyone.

Pioneer Spirit

My aim in this blog post is to help the absolute beginner get started, so the crypto Wild West can become a bit more hospitable and familiar. As this is an endlessly complex subject, this blog is the first part of a series. I will start with some basics – understanding the point of crypto, and some key distinctions that help us honour that point. I will not be discussing the mechanics of buying crypto as yet (that will be dealt with in a future post) as the why of crypto should rightly come before the how.

This is important because all too often, when I speak to novices, they talk as if the only point in investing in crypto is to make a killing in a rapidly rising market. There’s nothing wrong with wanting to make money, but crypto is far, far more than merely a profit opportunity, and focusing only on short-term profit is to miss most of its most important facets.

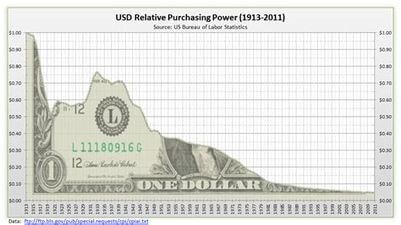

The early adopters of crypto had far better motivations. They wanted to create money which wouldn’t just replace one set of wealthy insiders with another set, but would facilitate a superior economy, by undermining the power of corrupt, centralised authorities in order to liberate people from their predations. They understood that those with monopoly power over money have strangled innovation, destroyed community cohesion, undermined entrepreneurship, speculated in assets at the expense of ordinary people, and created chronic inflation.

Price ‘Stability’, with love from the Fed

It is unfortunate, but probably inevitable, that these original motivations for creating crypto are being increasingly subverted – particularly by mainstream commentators and participants coming belatedly to the crypto party after scoffing on the sidelines for years. I will here discuss a crucial distinction within the crypto world to illustrate how the original purpose of crypto is being undermined, and what we can do to stop this happening.

This distinction relates to how much information you divulge when you buy and sell cryptos. As everyone knows, one of the most problematic aspects of the modern world is escalating surveillance, which is being used to reduce freedom in every aspect of life. Every normie financial institution insists that you declare important and sensitive information, through the Know Your Customer (KYC) process, which collects information, government-sanctioned identity instruments, and, increasingly, biometrics, to verify identities. The early crypto pioneers wanted to fight this intrusiveness by creating truly anonymous and secure payment systems, but this original intention has been steadily undermined, as KYC has been transplanted into the crypto space from the normie world.

Why Privacy?

Why did the crypto early adopters focus so strongly on the importance of anonymity? It wasn’t just an idle affectation, or a sign of intended criminality, but a key part of their reforming instincts. They appreciated the danger of the increasingly asymmetric power relations in society, and how big governments are using tactics like KYC to wield power over the little people. Striving for anonymity is the best method of warding off totalitarian strategies such as social credit systems. The fight for anonymity should therefore be at the forefront of our minds when we engage with cryptocurrencies.

This isn’t to say that KYC is quite as stringent in the crypto space as it is in Normieland. Cryptocurrency exchanges have less regulatory attention (so far) so can afford to be more relaxed when enforcing KYC requirements. A good example of a KYC-using exchange is Binance. Binance justifies its use of KYC with the following paragraphs:

This kind of normie-speak sounds oh-so-reasonable, until one remembers that most illicit financial practices couldn’t happen without the complicity of the banks that impose KYC regulations. And as for the notion that crypto should worry about its reputation with those fundamentally corrupt institutions…

Generally speaking, KYC-enforcing sites will be centralised, and those that don’t use it will be decentralised. With a centralised site, the site is stored on a single server in the old-fashioned way, and all trades flow through this site. With a decentralised site, the users download an app that allows them to act as a secure hub and trade with other users with their own separate hubs. This is what is known as a peer-to-peer network, and they allow for the complete anonymity and security that was desired by the original pioneers. Thus, we should ideally look for decentralised sites that allow us to preserve the purity of this original motivation:

A good example of a decentralised site is Bisq.com:

There are no prizes for guessing which category is true to the principles of the crypto pioneers, but it is amazing how few people go to the effort of finding non-KYC sites. In fact, the vast majority of people buying crypto are using exchanges which require KYC verification. This isn’t because alternatives don’t exist, but because most of the ‘how-to’ guides that people see downplay the importance of anonymity, and send readers to the KYC sites like unwitting lambs to slaughter.

Generally speaking, KYC-using interfaces are judged to be more ‘user-friendly’, and this is how they are promoted to newbies. However, for the sake of the original promise of crypto, it is worth making a little bit of effort to use non-KYC sites.

A good resource when it comes to finding non-KYC options is the site KYC Not Me (kycnot.me/about). It’s a simple site run by an anonymous altruist (in the true crypto spirit), that provides a few suggestions about good exchanges and services, using an easy-to-understand rating system:

In a future blog, we will go through the process of buying crypto on a non-KYC site. However, the next post will deal with another important principle – autonomy – and how it can be ensured in the crypto space.

Thank you for reading,

Anna, investor and team member of NoHypeInvest.